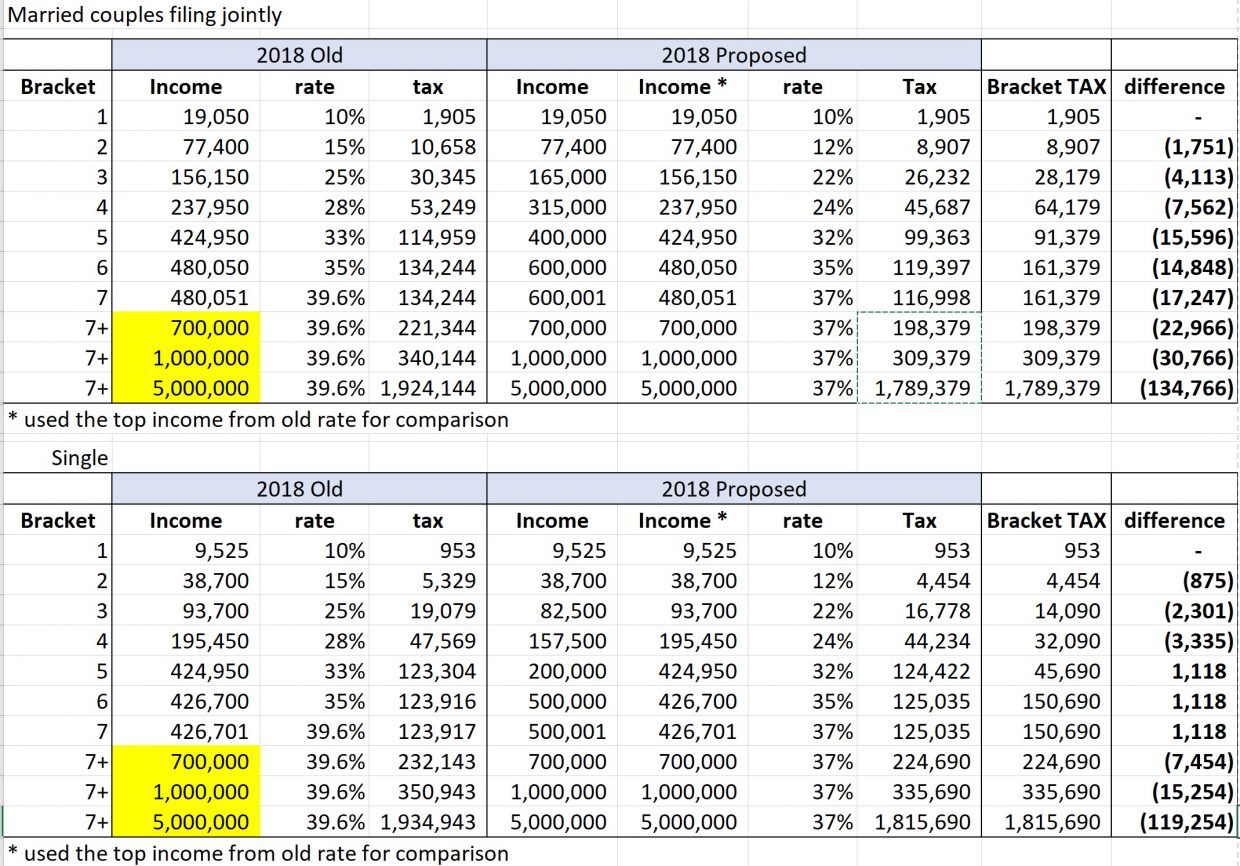

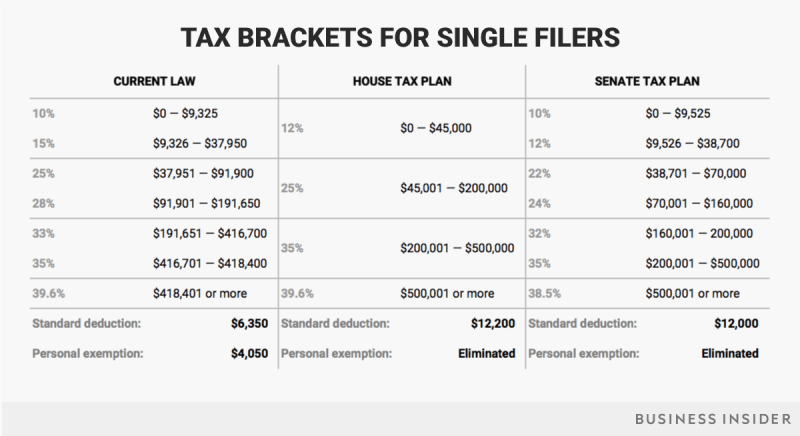

If you have any questions on how you will be affected by the revised tax rates, contact Doshi and Associates for a consultation! 248.858. Kentucky Income Tax Withheld Current, 2022 - Schedule KW-2 - Fill-in. For purposes of this Insight, the reference to means US dollars. Job Expenses and Miscellaneous Deductions subject to 2% floorīelow are the bracket comparisons of tax rates from 20. United States: Summary of key 20 federal tax rates and limits many changes after tax reform MaIn brief The following is a high-level summary of some key individual tax rates and applicable limits for 20.Significant Changes to itemized deductions include: Since there will be no personal exemption amounts for 2018, individual and married taxpayers will need to review the new rates and standard deductions to determine if they are required to file a tax return.Īdditional tax credits and deductions adjusted for 2018 include: The additional standard deduction for the aged or the blind is $1,300 and unmarried taxpayers additional standard deduction will increase to $1,600. Standard deduction amounts will increase to $12,000 for individuals, $18,000 for heads of household, and $24,000 for married couples filing jointly and surviving spouses. It is set up to take a greater percentage from high-income earners than from lower-income earners.

brackets and thus increase the joint estimate relative to the individual tax.

federal tax system is progressive, meaning that it is based on the concept of one’s ability to pay. Third, tax expenditure estimates account only for changes in income taxes. For the tax year beginning January 1, 2018, tax brackets and rates will be changing.

0 kommentar(er)

0 kommentar(er)